suvs insurance affordable cars trucks

suvs insurance affordable cars trucks

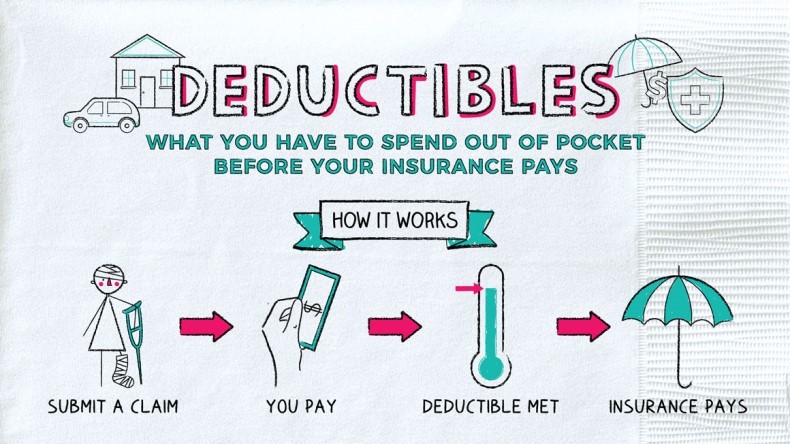

Deductibles Impact Exactly How Much You Pay For Cars And Truck Insurance, This is only the expense of your deductibles. A higher car deductible limitation can result in lower costs, while a lower insurance deductible limitation can raise your regular monthly costs and the total price of vehicle insurance coverage.

Currently, allow's say that you enhance your deductible to $250. An insurance deductible restriction of $500 would result in lower month-to-month vehicle prices of $129 - insurance.

cheapest cheaper cars credit dui

cheapest cheaper cars credit dui

Like, upping your insurance deductible from $1,000 to $2,000 may only save you around 6%, while $500 to $1,000 can save you approximately 40%. There are some deductibles that aren't worth it. When is a Car Insurance Coverage Insurance Deductible Paid? What figures out whether or not you'll need to pay a deductible is the scenario of the automobile damages and what car insurance coverage plan you use to cover it.

Nonetheless, what does permit you to pay deductibles before the automobile insurance provider covers the repair service prices are: - Obligation insurance coverage will not enable an insurance deductible for repairs to problems endured in a mishap that was the fault of another driver. car insurance. Currently, if you were at fault for the accident and also damages, then harms to your cars and truck would certainly be covered by your crash plan, which enables insurance deductible use.

See This Report about Understanding Insurance Deductibles And Premiums

After filing the vehicle claim, you would certainly be able to pay your insurance deductible. - In no-fault states, whoever triggered the crash to begin with isn't important and also needs chauffeurs to bring no-fault or personal protection car insurance coverage. This covers injuries and also damages to your vehicle - car insurance. You pay the individual security deductible when you submit your car insurance claim.

The other driver would certainly cover you. If your damage surpasses their own auto insurance coverage limits, you may be able to pay a deductible towards it. insurance companies. When Isn't a Vehicle Insurance Coverage Deductible Paid? Paying an insurance deductible is necessary for two out of the 3 prepare for complete vehicle insurance coverage accident and extensive.

low cost car cheaper cars You can find out more liability

dui cheap car insurance cheaper auto insurance auto

dui cheap car insurance cheaper auto insurance auto

Perhaps you don't desire the deductible amount deducted from your insurance payout. insure. If that holds true, right here are a number of ways you can prevent paying your deductible if undesired: - As stressed out throughout, if you are hit by an additional driver, then their responsibility auto insurance would cover the costs of your repairs and injuries - cheap insurance.

- In a situation where you need to pay your deductible but do not intend to, you may be able to function out something with the mechanic. They would certainly bill your auto insurer sans the insurance deductible quantity while you established a layaway plan - car insured. The technician may hold your vehicle until the deductible is paid. cars.

The smart Trick of Choosing Your Deductibles To Save Money - National Bank ... That Nobody is Discussing

- While it varies with auto insurance firms, you may be able to waive your deductible when you file an insurance claim. The technician or vehicle shop will certainly bill your insurance company without the insurance deductible.

As opposed to replacing them, they repair them, considered that the damage isn't as well extreme. You will not have to pay a deductible to your cars and truck insurance coverage carrier. low-cost auto insurance. Best Technique For Establishing Your Deductible, When deciding on what your automobile deductible amount ought to be if you ever before require to sue, there are numerous variables to think of.

At the exact same time, it aids to consider what your individual budget permits. Below's what you should consider regarding your vehicle insurance when setting your insurance deductible limitation: - A vehicle deductible is paid by the insurance holder out of pocket. Start by asking yourself if you have the ability to pay $500 or $1,000 at any provided moment considering that crashes do occur.

- With your insurance deductible, assume regarding just how much your cars and truck insurance provider will payment after you file your claim. Would a higher regular monthly auto costs deserve the lower deductible, or the other way around? - If another motorist (with vehicle insurance coverage) is responsible for any kind of problems, after that you do not have to pay the insurance deductible considering that it's the various other driver's insurance covering it (cheap).

The 5-Minute Rule for Auto Insurance Deductibles: How Do They Work?

So, the regular monthly premiums might be a little much, however that implies that the deductible is low. Many motorists of leased cars choose reduced deductibles that use more insurance coverage. - There isn't just one kind of insurance deductible. Each plan, like detailed and also crash, has its own deductible limitation that you get to establish. affordable car insurance.

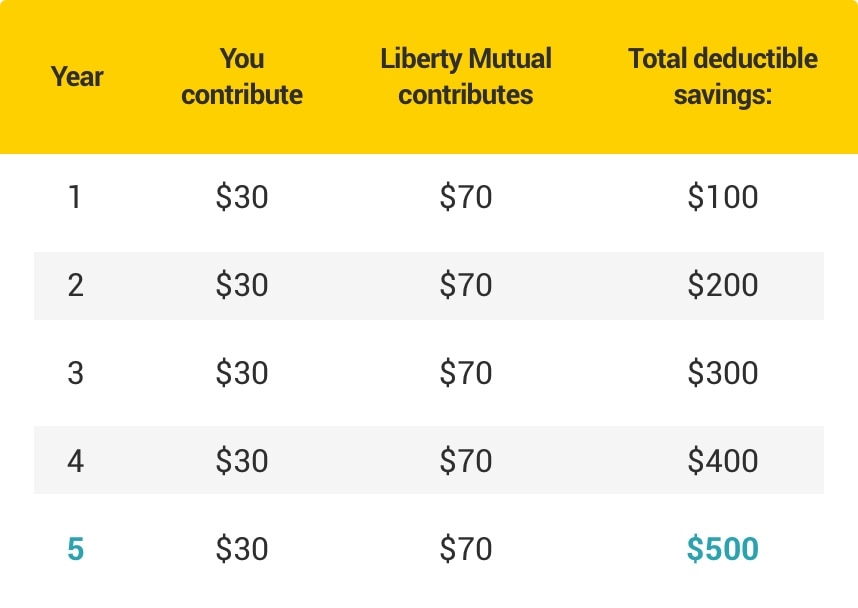

They're able to establish their accident deductible reduced or higher than their comprehensive deductible. Disappearing Insurance Deductible Discount Rate, A vanishing deductible is a protection option where the insurance policy holders pay a fee for lower deductibles whenever an insurance claim is filed. cheaper cars.

At the same time, it's straight proportional to your month-to-month prices. There are also a pair of ways you can save on those rates by searching or packing various other sorts of insurance with a particular firm - insurance companies. While it is a good suggestion to decrease your insurance deductible if you desire much more insurance coverage, it's not the very best strategy to elevate them if you desire your auto insurance coverage to be less costly.

liability low cost cheapest car insurance insured car

liability low cost cheapest car insurance insured car

Choosing an automobile insurance coverage deductible can lead to severe economic ramifications otherwise done right. Deductibles are indeed a resource of confusion and aggravation for many individuals, especially thinking about the selection of options offered. prices. It's hard to determine whether to opt for a high costs or high insurance deductible with car insurance coverage.